Access LGD Data Here

Access LGD Data Here

Quick Links

Access ESG and Climate Risk Resources here!

Download the new LGD and PD Reports!

See Upcoming Events!

Provides risk insights directly from anonymized internal data of member banks and promotes knowledge sharing within the financial industry.

The long time series of historical credit losses allow banks to model loans’ recovery processes. GCD provides also credit rankings and obligor internal rating transition data for all key bank portfolios.

Data Pooling : PD & LGD

GCD is a unique data consortium that collects banks’ internal data for both PD and LGD. GCD’s data pools support the key parameters of banks’ credit risk modelling: Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD).

Library: Research & Publications

GCD’s library gives access to a wide variety of publications on risk-related topics. GCD members work together to analyze data and discuss methodology issues.

GCD is actively promoting academic research on the data collected.

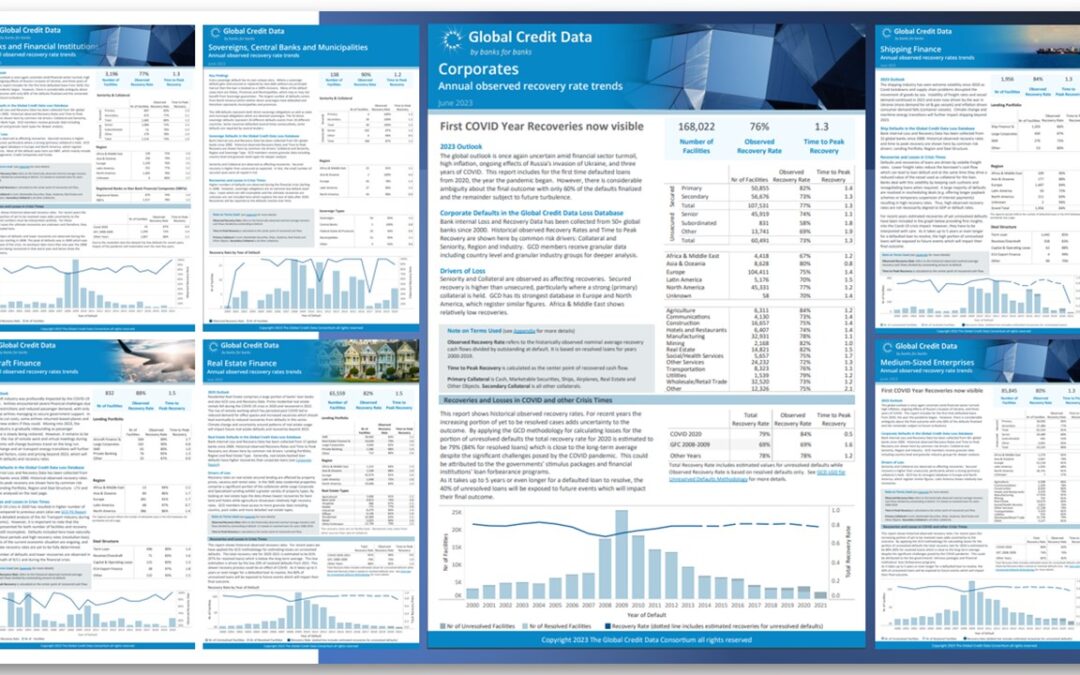

Data Insights & Reports

Discover the latest insights on credit risk with GCD's published reports, offering valuable industry analysis and benchmarks.

Services: Benchmarking

Global Credit Data collects raw data from its members and distributes it back to them for use in their own analysis and modelling.

Member banks can create dynamic Reference Data Sets and generate instant views on the data.

Services: ESG and Climate Risk

Global Credit Data members have a collaborative platform to exchange data and knowledge with their peers on how to incorporate climate and environmental factors into credit risk modeling through industry-wide best practices

Latest Insights

NGFS Climate Scenarios Q&A

Presentation can be accessed here. Are compound risks also included? No compound risks are not yet covered by the scenarios at this point in time. This limitation has also been noted by us, and we have drafted a note that covers the topic, and explains how this could be potentially…

Climate Focus Group Update March 2024: Climate Stress Testing, Global Events & Regulatory News and more

GCD Climate Risk Focus Group where climate and credit risk measurement come together! Dear GCD Members and Friends, Stay informed with the latest activities in Climate Risk at GCD: Information on upcoming webinars featuring insights on Climate Stress testing from the National Bank of Canada and the latest insights on…

Register now! GCD Toronto Conference 2024 | April 29th

Register Now for Toronto Conference Spring 2024

Announcing the Latest Data Release!

With over 30,000 names spanning across North America, Europe, South Africa, and Australia, banks utilize our Name Benchmarking data pool as a valuable resource for comparing risk parameters with their counterparts in similar regions.

GCD Recovery Rate for Loans with Insurance Guarantors

Global Credit Data and ICC and ITFA Collaboration: Recovery Rate for Loans with Insurance Guarantors

Academics

Global Credit Data is proud to support academic research to further the study of finance.

Events

GCD hosts events throughout the year for members and industry leaders on topics that benefit banks.

GCD Newswire

GCD actively publishes reports and studies about how data will impact different industries.

GCD Data User Guide

Data quality is key to GCD and the extensive documentation forms an integral part of GCD's data quality approach.