What we do

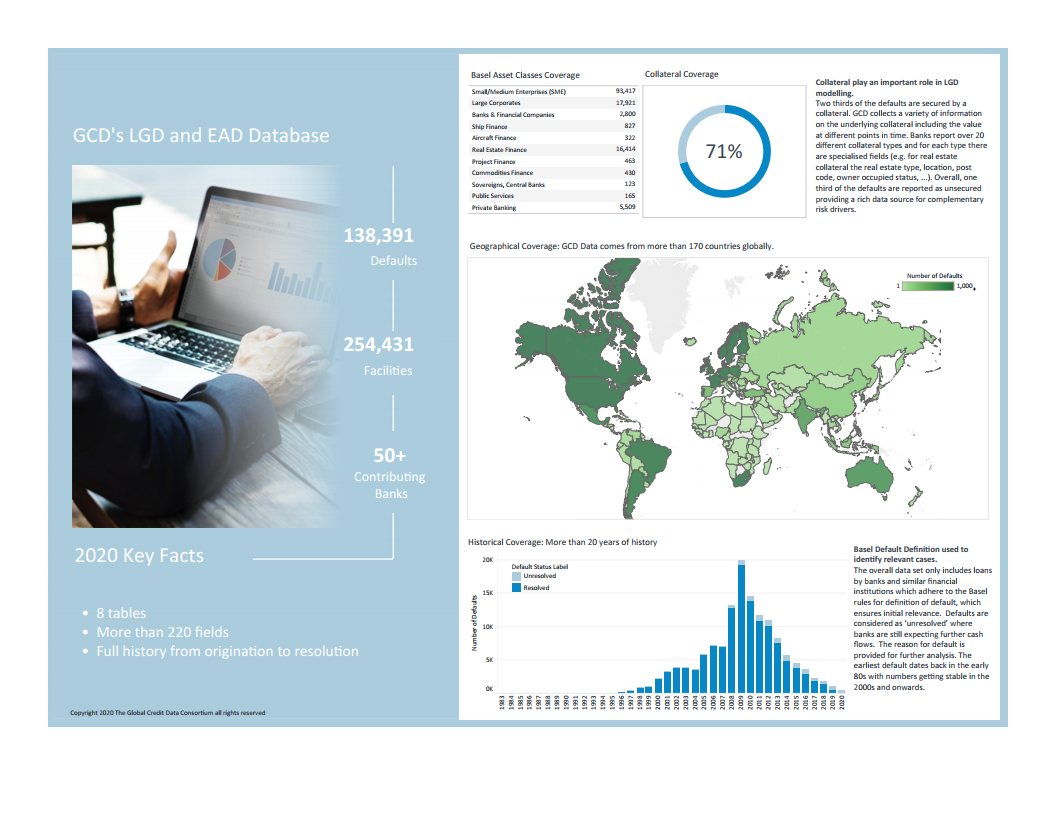

GCD is collecting data related to credit failures (default) dating back to the early 1980’s, allowing for meaningful statistics in terms of type of borrower, time and size of exposure at default and collateral recovery rates.

Data is collected and analysed separately various Basel 2 asset classes and supports various definitions of LGD and credit conversion factors (CCF).

The LGD and EAD parameters are most demanding in terms of multiple and precise data on the obligor, the loan and surrounding circumstances. At the current stage, Global Credit Data offers a mature structure for LGD/EAD pooling, which the member banks can and do adopt in their internal databases. Global Credit Data is internationally recognized as the standard for LGD and EAD data collection.

How can the database be embedded in your regular processes

Some concrete use cases are:

- Identify risk-drivers on a more diverse dataset (e.g. Segmentation, LTV, Time-to-Recovery, …)

- Identify macro-economic dependencies of LGD and EAD

- Prove the correct LGD levels for Low Default Portfolios (e.g. banks, shipping)

- Correctly calibrate downturn or stressed LGDs from long time series

- Reduce uncertainty add-ons for lack of data

- Benchmark historical losses with your modelled forward-looking expected losses under IFRS 9 / CECL

- Peer benchmark the LGD estimates underlying your pricing models with loss rates from a global and diverse dataset