Members from across the banking industry came together to discuss the pressing global credit risk issues that banks are facing. Global Credit Data was proud to have hosted several important guest speakers this year featuring talks from the European Banking Authority (EBA), the European Commission, FCG, and NPL Markets.

|

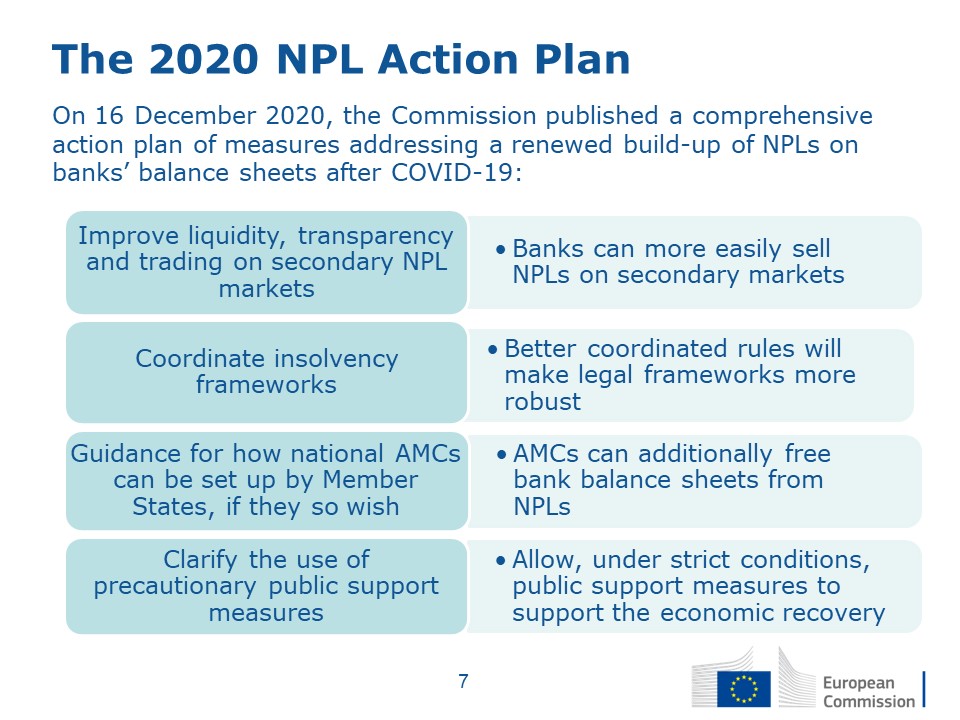

2021: NPL MarketsCredit risk data: The recommended data hub for the European NPL market: by the European Banking Authority (EBA) and the European Commission, parallel with an industry initiative. Round Table with European Commission (Nicolas Willems), NPL Markets (Burkhard Heppe) and UniCredit (Giovanni Madaro) |

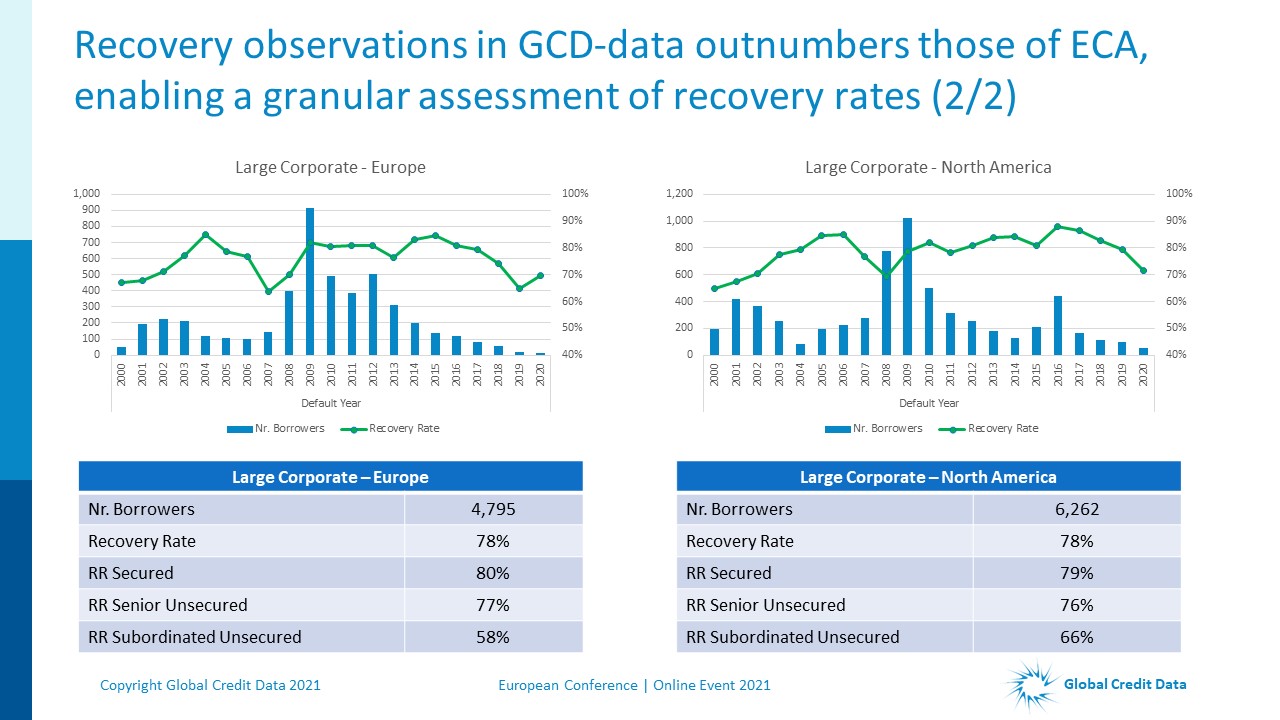

Recovery Rates

Business Case: Modelling the Fair Value of illiquid bank loans, using GCD data: different approaches, products/markets adequate LGD, calibration.

Guest speakers: Danny Dieleman (ING Bank) |

|

|

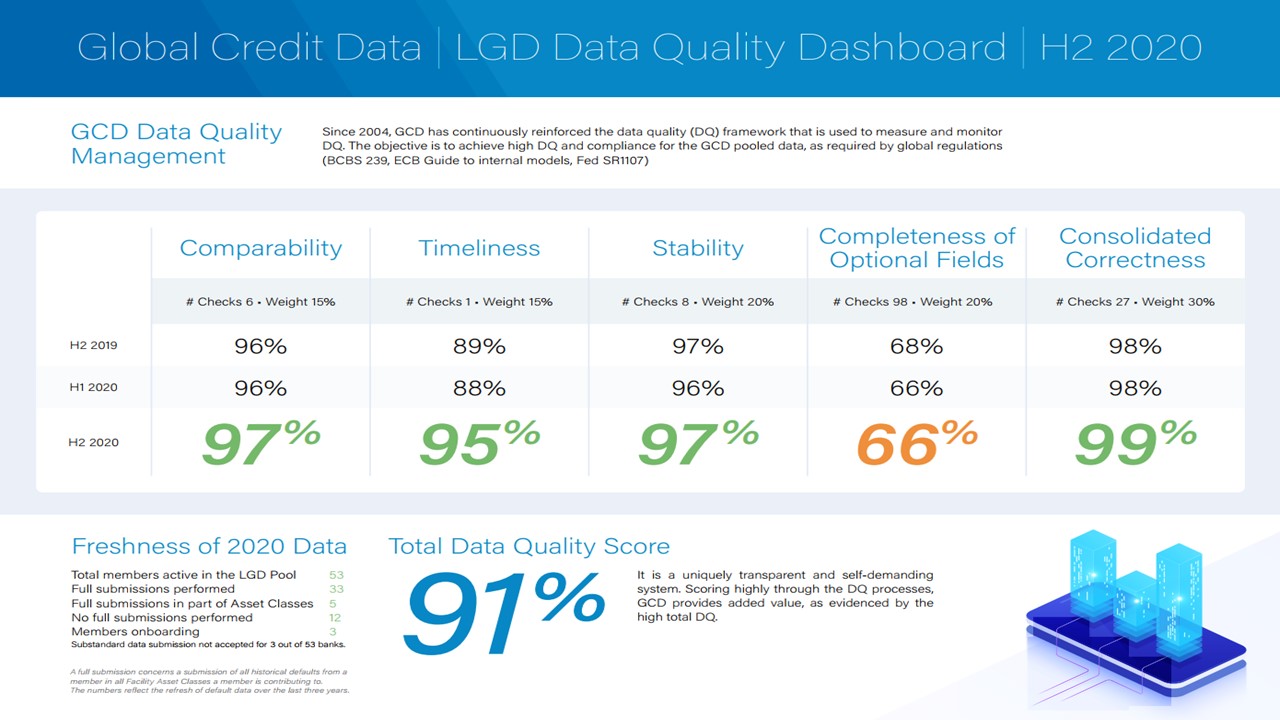

GCD: Data QualityOn day two of the conference Erik Rustenburg en Ben Galow, author of GCD’s Data Quality study, discussed the importance of data quality. Here is was showcased, that the quality of GCD data is consistent over time. GCD also unveiled its’ data quality score, which is currently 91%! |

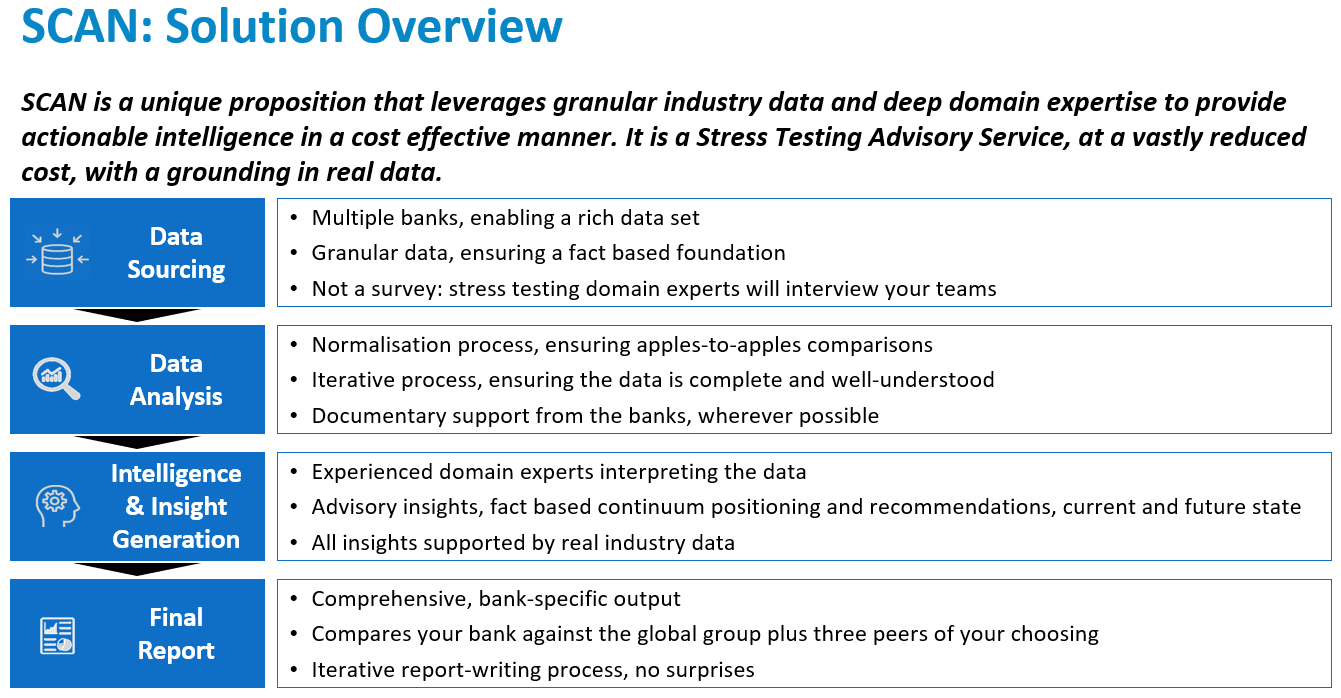

CRISIL: Stress Testing Advisory StudyNow, more than ever, having a birds’ eye view of industry best practices is important for Regulatory and Internal Stress Testing. The CRISIL team explained some of the new initiatives in this field. Reach out, as there are exciting prospects for this collaboration between GCD and CRISIL. |

|

| Opening GCD Overview and Conference Program | Slides (Only for Member after Login) |

| Stress Testing – CRISIL | Slides ( Public ) |

| NPL Presentation | Slides (Only for Member after Login) |

| LGD_FairValue | Slides (Only for Member after Login) |

| Unresolved Cases of LGD | Slides (Only for Member after Login) |

| Comparison of traditional modelling techniques and machine learning for prediction of LGD – FCG | Slides (Only for Member after Login) |

| Benchmarking Rating Transitions and Obligors using GCD PD Data | Slides (Only for Member after Login) |

| EBA report on benchmarking of loan enforcement procedures | TBC |

| ICC GCDTRcollaboration /Trade Finance | Slides (Only for Member after Login) |

| Academic Committee | Slides (Only for Member after Login) |

Day 2

| Opening GCD Overview and Conference Program | Slides (Only for Member after Login) |

| GCD Data Quality | Slides (Only for Member after Login) |

| GCD Unresolved Conference_METHODOLOGY | Slides (Only for Member after Login) |

| IIF_MLCRG | Slides (Only for Member after Login) |

| European Online Event: LGD methodology using Machine Learning | Slides (Only for Member after Login) |

| GCD benchmarking utility presentation | Slides (Only for Member after Login) |

| Downturn LGD | Slides (Only for Member after Login) |

| GCD European Conference Mar 2021 – d-fine EEFIG | Slides (Only for Member after Login) |