- This event has passed.

Masterscale working group: Information session # 2

February 23, 2021 @ 2:00 pm UTC+1

Second Session of Masterscale Working Group

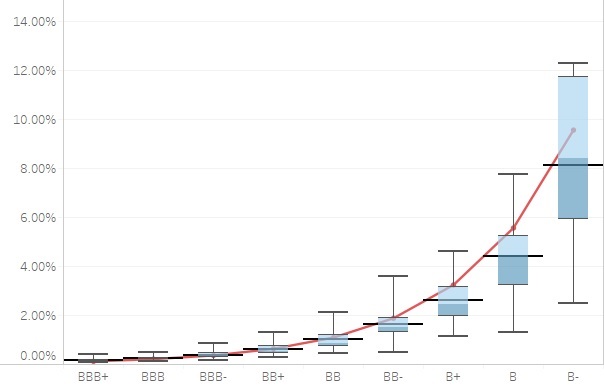

The Covid-19 pandemic is heavily impacting banks’ PD and ratings systems. GCD would like to launch a working group to investigate the interaction between masterscale and PD model output.

This working group will focus on the most efficient, agreed and available methodologies used to calibrate PD and rating systems, and the best practices to be shared among practitioners in the banking industry.

The information session is open to all member banks and will be presented by Mike Jacobs, PhD

Please complete the survey here

If you would like to participate in the working group, please register here