Global Credit Data thanks all presenters, organizers and participants for another great conference in Stockholm. SEB was the perfect host to an unbelievable event with a special Nordic touch. Europe’s credit risk professionals came together and discussed the latest developments in the credit risk area.

TOP SPEAKERS:

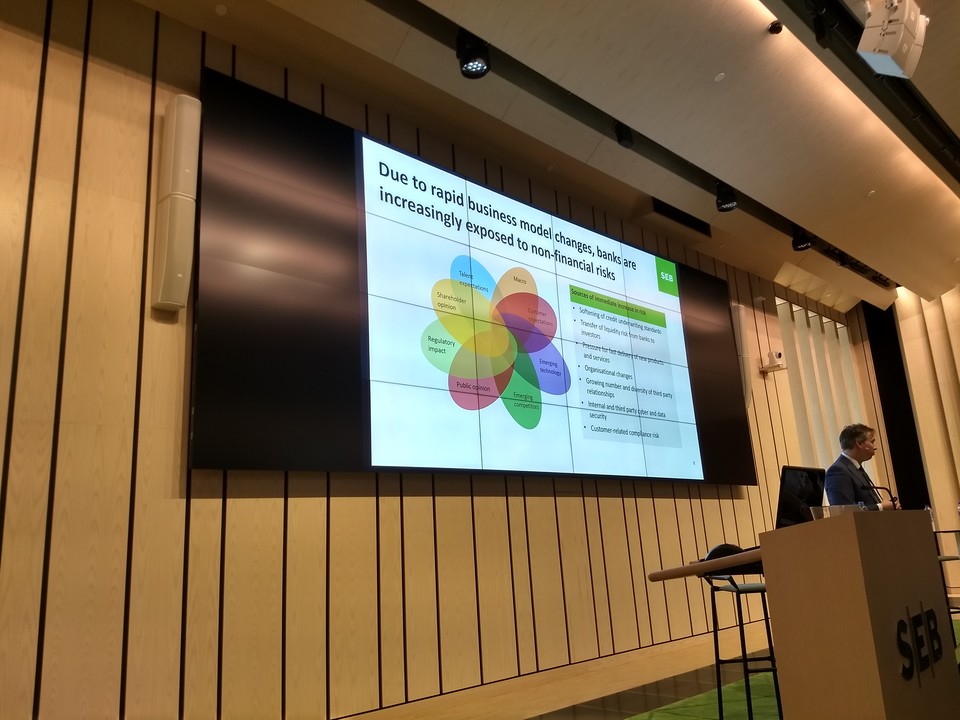

Magnus Agustsson, CRO SEB: A CRO’s perspective on the future of risk management

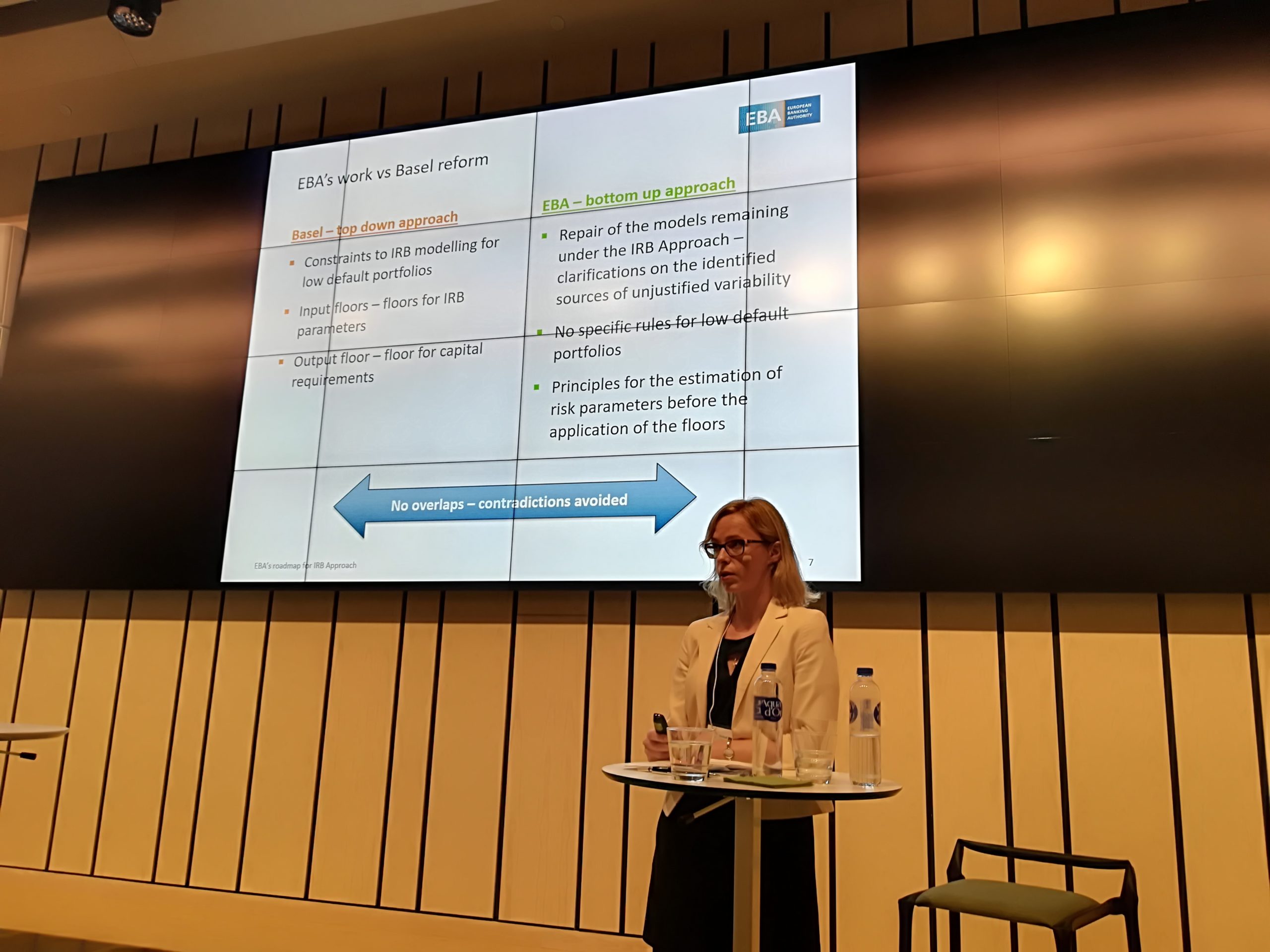

Dorota Siwek, EBA: EBA’s review of the IRB approach

Panel Basel III Finalisation: The end of modelling or the start of harmonization? with Jean-Gabriel Albigot (Societe Generale); Stephan Jortzik (ANZ); Massimo Cutaia (Credit Suisse); Natalia Bailey (IIF); Constance Usherwood (AFME) and David Eschwé (Raiffeisenbank)

Atif Khan, Westpac: Non-retail EAD modelling with GCD data

FURTHER IMPRESSIONS:

Rehearsal before conference start … showing Theo van Drunen, ABN Amro, Chairman of the Board and Philip Winckle, Executive Director GCD

What would be Stockholm without a boattrip …