by Nina Brumma | Jun 19, 2023 | 2023, Media, News, News Highlight, Newswire Page, Public

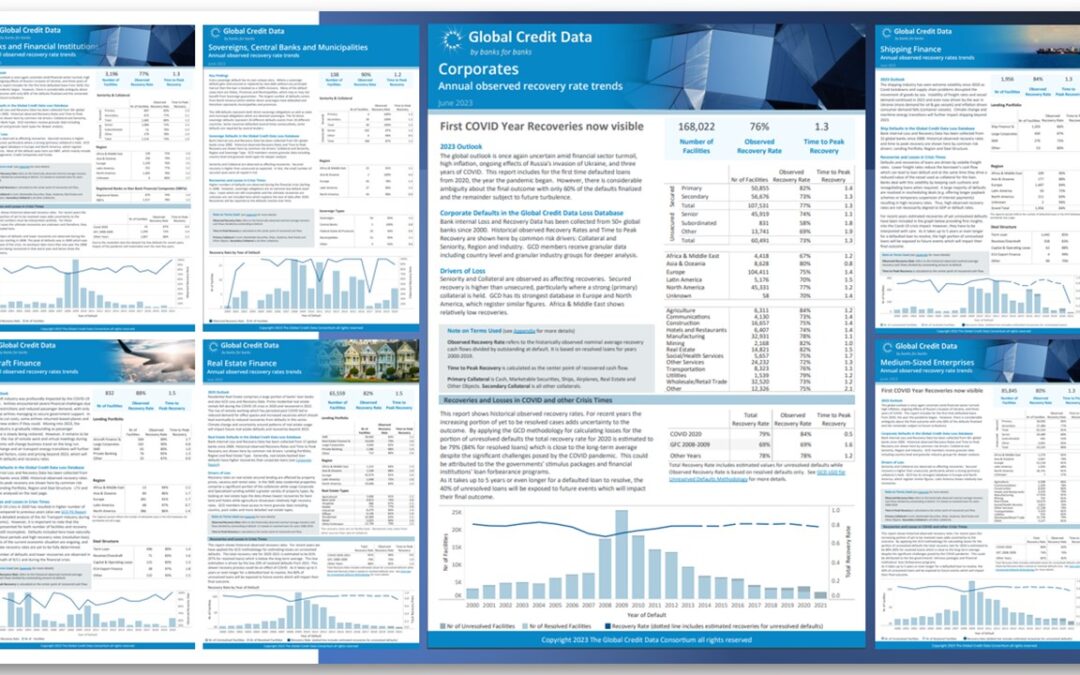

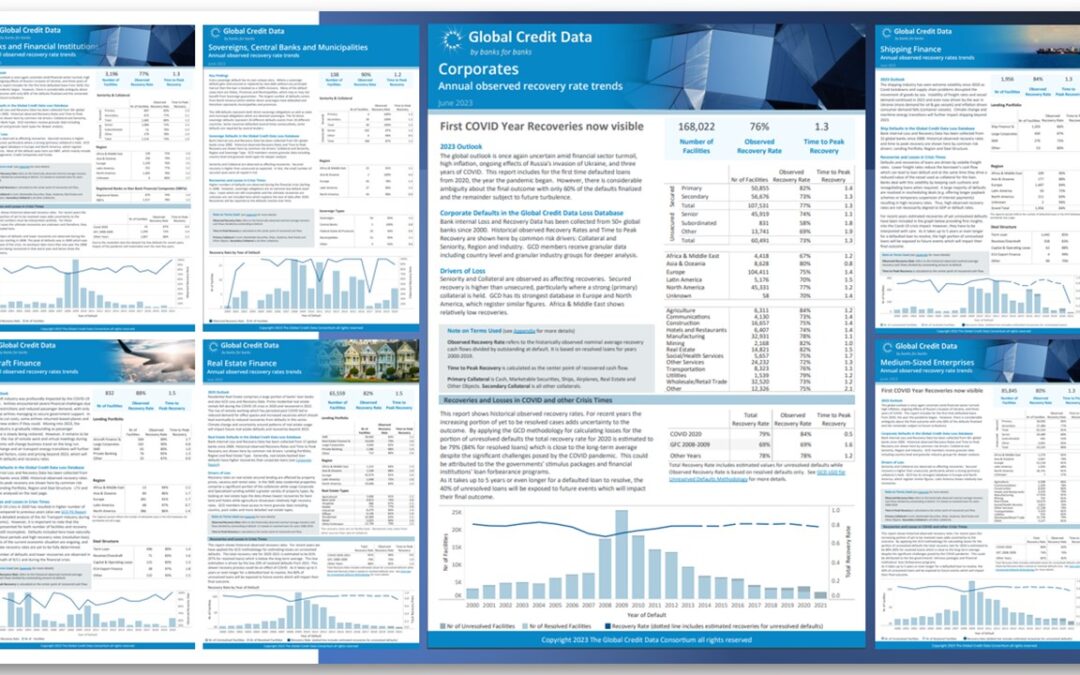

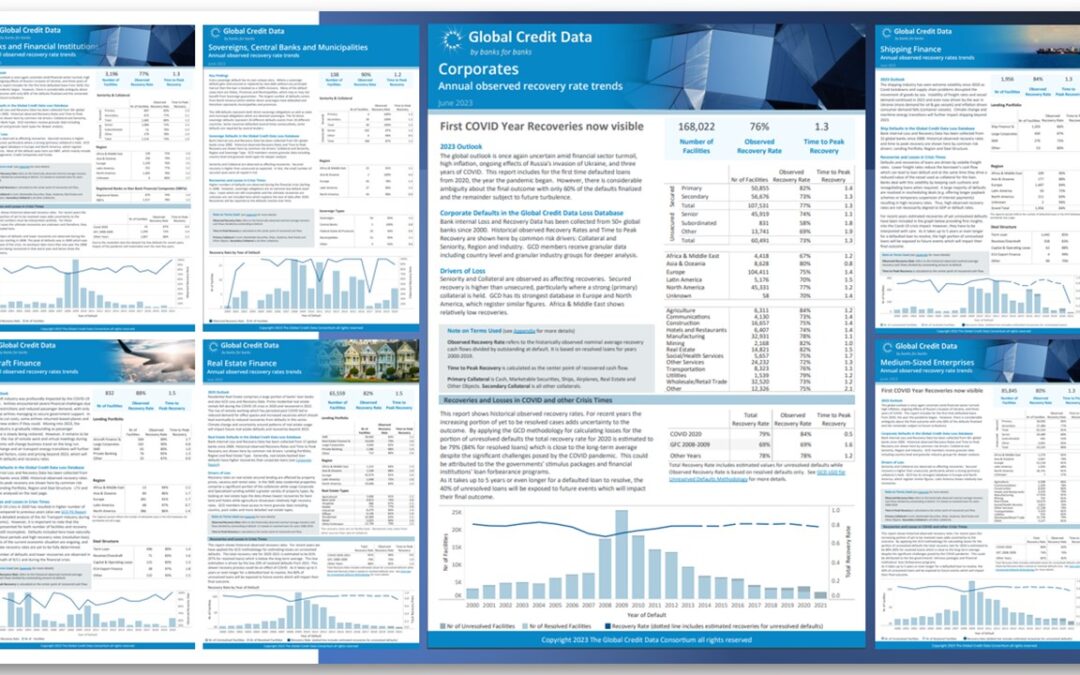

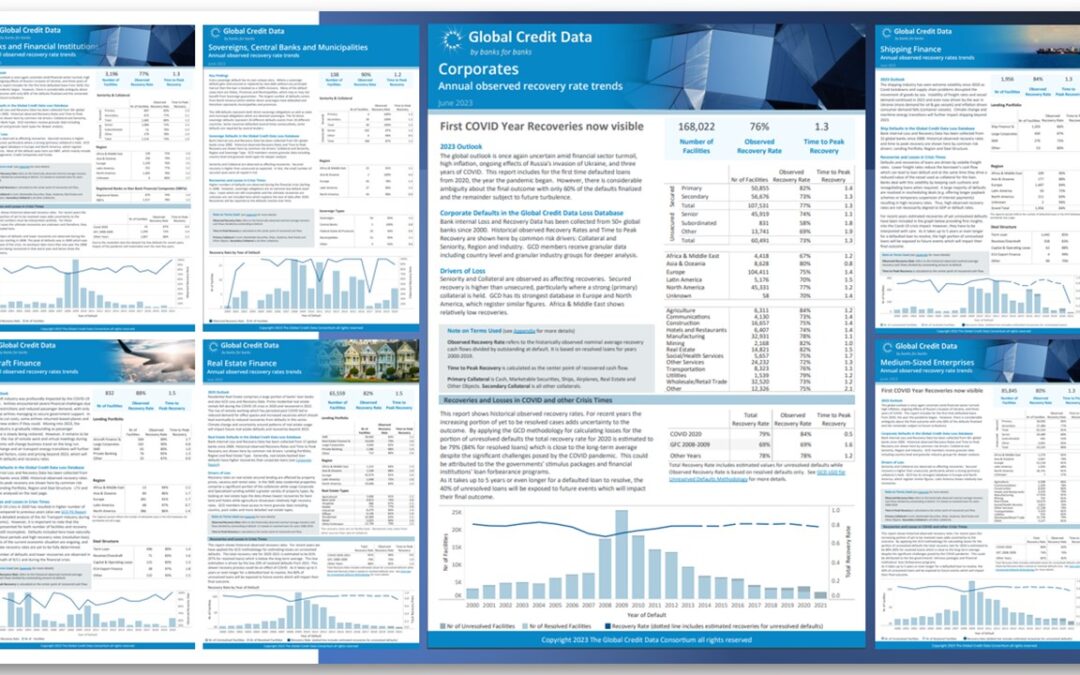

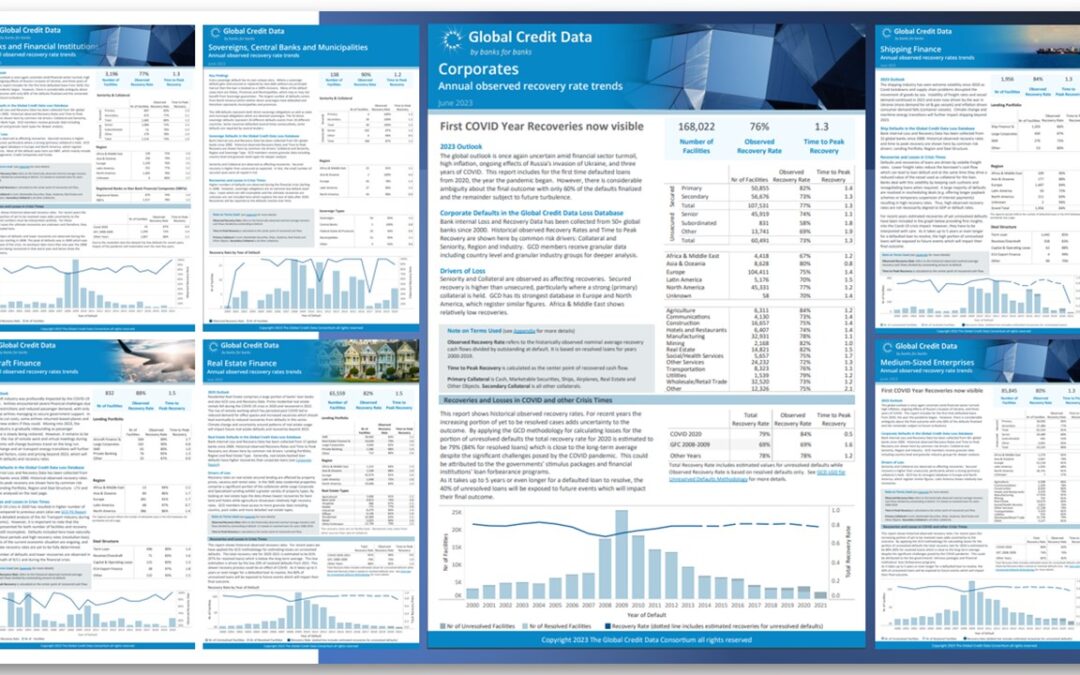

We are delighted to announce the publication of our highly anticipated Recovery Rate Reports 2023, providing insightful findings on the impact of COVID-19 on LGDs for the first time. These reports offer valuable insights for Corporates, Banks, SMEs, Sovereigns,...

by Hale Tatar | Mar 13, 2023 | 2023, Media, News, News Highlight, Newsletter, Newswire Page

Read the March 2023 Newsletter here....

by Erik Rustenburg | Feb 21, 2023 | 2023, News, Public

Since 2004, GCD has continuously reinforced a framework that is used to measure and monitor Data Quality (DQ). The objective is to achieve high DQ and compliance for the GCD pooled data, as required by global regulations (BCBS 239, ECB Guide to internal models, Fed...

by Hale Tatar | Apr 22, 2024 | 2024, ESG Climate Risk, Public

Presentation can be accessed here. Are compound risks also included? No compound risks are not yet covered by the scenarios at this point in time. This limitation has also been noted by us, and we have drafted a note that covers the topic, and explains how this could...

by Hale Tatar | Mar 26, 2024 | 2024, ESG Climate Risk, News, News Highlight, Newsletter, Newswire Page, Public

GCD Climate Risk Focus Group where climate and credit risk measurement come together! Dear GCD Members and Friends, Stay informed with the latest activities in Climate Risk at GCD: Information on upcoming webinars featuring insights on Climate Stress testing from the...

by Hale Tatar | Feb 5, 2024 | ESG Climate Risk

by Hale Tatar | Jan 25, 2024 | 2024, Media, News, News Highlight, Newswire Page, Public

Visit Conference page for registration and more...

by Akanna Okeke | Dec 20, 2023 | 2023, News Highlight, Public

We’re excited to announce the latest data release for the Name Benchmarking platform. This marks the fourth and final run of the year for this data pool, in which participating banks exchange risk ratings and parameters for the same borrowers. With over 30,000 names...

by Akanna Okeke | Dec 14, 2023 | 2023, Newsletter, Newswire Page, Public

Read the December 2023 Newsletter here. Access...

by Hale Tatar | Dec 11, 2023 | 2023, Media, News, News Highlight, Newswire Page, Public

Global Credit Data and ICC and ITFA Collaboration: Recovery Rate for Loans with Insurance Guarantors GCD has been working with the International Trade & Forfaiting Association (ITFA), who is spearheading the Basel advocacy in relation to more favorable capital...

by Hale Tatar | Nov 9, 2023 | 2023, Media, News, News Highlight, Newswire Page, Public

Exciting News! GCD is excited to be a key partner in the release of the ICC Trade Register Report. The ICC Trade Register Report 2023 is here, providing a deep dive into credit risk in trade, supply chain, and export finance – crucial insights in today's uncertain...

by Hale Tatar | Oct 24, 2023 | 2023, Newsletter, Newswire Page, Public

Read the July 2023 Newsletter here. Access...

by Jakub Tomczyk | Oct 2, 2023 | 2023, Media, News, News Highlight, Newswire Page, Public

Join the GCD Representativeness Focus Group (RFG) to shape our approach to representativeness in the context of credit risk models! The concept of representativeness, which we will define strictly, is at the core of model building and whenever pooled data is used. ...