Global Credit Data History

GCD's Mission is to help banks understand and model credit risks. Activities include:

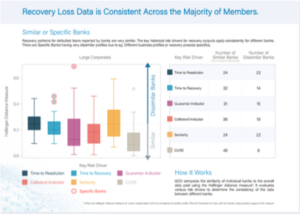

- Pooling credit loss data directly from banks’ books, especially for low default portfolios

- Providing benchmarks

- Facilitating knowledge exchange

- Fostering research & online information sharing services

History

Since 2004 Global Credit Data has enjoyed remarkable success – both in terms of growing its membership and establishing its international reputation through the creation of the largest existing loss and recovery dataset for commercial loans. Its Loan Loss database currently contains over 250,000 individual facility default records from over 70,000 obligors across 120 different countries over a period from 1990 to date. The database is fed by Member-banks with all new defaults bi-annually. Over the years, Global Credit Data continuously professionalized and amended its databases to facilitate the increased use of its data e.g. in the context of IFRS 9 / CECL impairment modelling.

Membership has grown from 11 to a current membership of 50+ Member-banks across Europe, Africa, Asia, Australia and North America.

Global Credit Data strives to enlarge its membership across the world because it believes that a global standard for data collection is in the interest of the financial industry as a whole.

Members

Current members

Global Credit Data was established in December 2004 as a loose affiliation of 11 major banks. Since then membership has grown to 50+ member banks across Europe, Africa, North America, Asia and Australia. GCD Members are ‘owners’ of the association, and data, and have a prominent role in steering the strategic direction. This ensures GCD activities are member-centric driving the ‘by banks for banks’ credo.

How to become a member

Global Credit Data welcomes and encourages new members. Global Credit Data membership is open to any financial institution that has a demonstrable capability to collect and deliver data which is compatible with the data of other members of the association. A special emphasis lies on the compatibility of the default definition, where Global Credit Data members use the Basel III definition.

The basis of the membership agreement is to adhere to the Articles of Association and to the internal rules of the Association, called Data Pool Regulations. Only corporate bodies – in practice registered banks – can be members.

Infrastructure

Since the creation of Global Credit Data, Data Quality, Confidentiality & Security has been the Top Priority overseen by the Executive Director & Board of directors always reaching exceeding All Member Banks Internal Requirement.

Information Security

GCD is using Bank Grade information security best practices & Procedure

- INfrastruture Security incl Encrytion at rest & in Transit, Certification, ...

- Access security incl MFA, IP address filtering , ... Basically all features given by Microsoft Azure

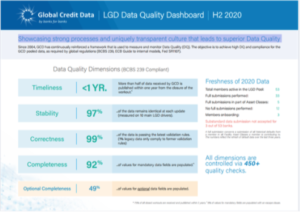

Data Quality Management

To ensure the quality of the data GCD established and implemented an effective data quality management framework which developed since its existence over the last 15 years.

Data Quality Governance

GCD implement a strong Data Quality governance with High implication of Members